Condo Insurance in and around STOUGHTON

Unlock great condo insurance in STOUGHTON

Protect your condo the smart way

Condo Sweet Condo Starts With State Farm

With the variety of condo insurance options to choose from, you may be feeling overwhelmed. That's why we made choosing State Farm uncomplicated. As one of the leading providers of condo unitowners insurance, you can enjoy outstanding service and coverage that is competitively priced. And this is not only for your condominium but also for your personal belongings inside, including things like electronics, cookware and sound equipment.

Unlock great condo insurance in STOUGHTON

Protect your condo the smart way

State Farm Can Insure Your Condominium, Too

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condo unit from vandalism, a hailstorm or a tornado.

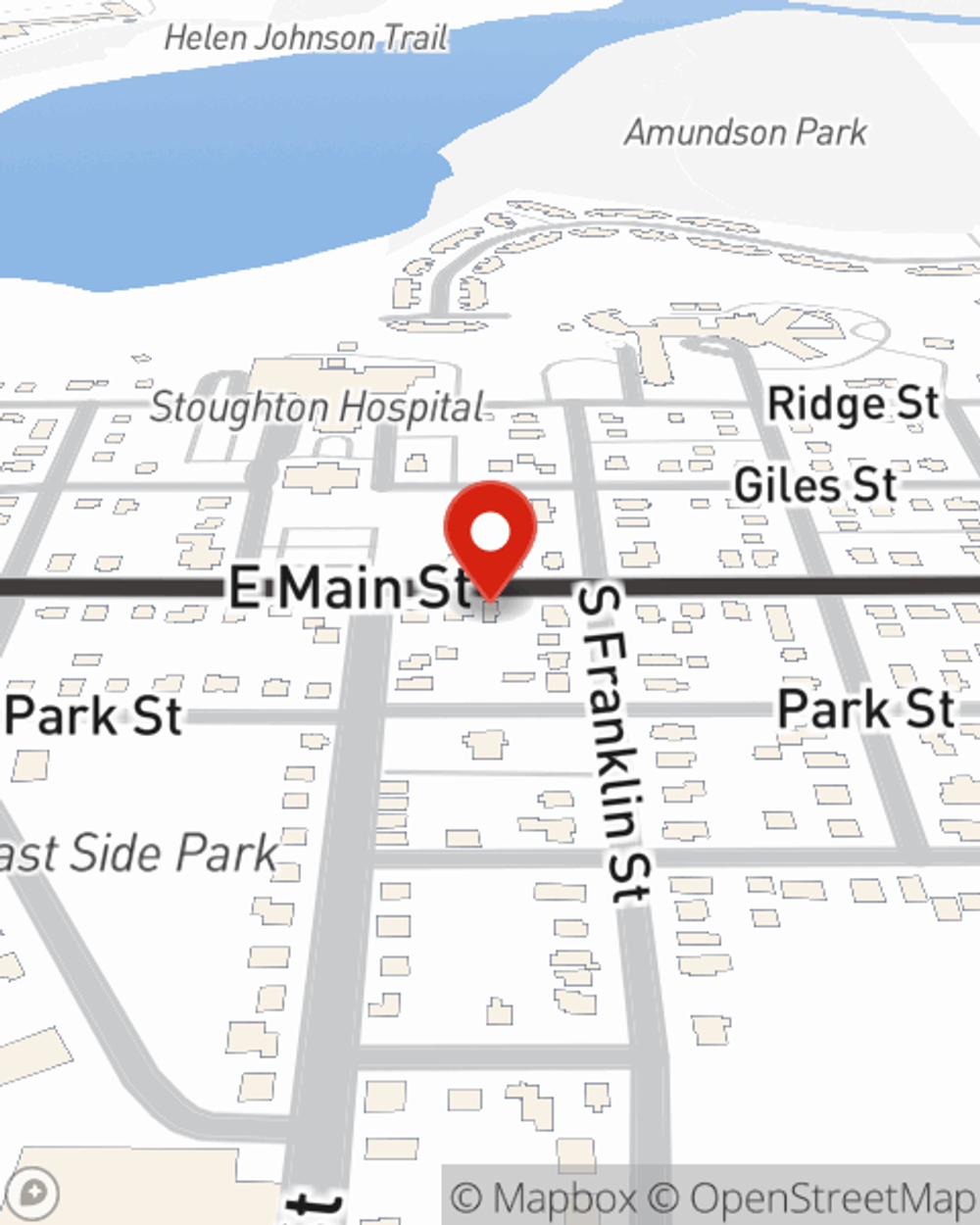

There is no better time than the present to reach out agent Ruth Ann Murphy and ask any questions you may have about your condo unitowners insurance options. Ruth Ann Murphy would love to help you find the most appropriate coverage for you.

Have More Questions About Condo Unitowners Insurance?

Call Ruth Ann at (608) 873-5654 or visit our FAQ page.

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Ruth Ann Murphy

State Farm® Insurance AgentSimple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.